Closing the gender gap in climate investment: A Q&A with the Drawdown Fund’s Laura Witt

Power Dynamics is an interview series highlighting the work, ideas, and voices of advocates working to build a clean energy future that is accessible, workable, and just for all.

As a General Partner at the Drawdown Fund, Laura Witt spends her days investing in companies making a difference in the climate fight. It’s important work. But sometimes, her other roles have to come first — on the morning we scheduled this conversation, a last-minute snag in the school drop-off rodeo for Laura’s kids altered our plans slightly. It’s a balancing act that I know well as a fellow working mom of two young children.

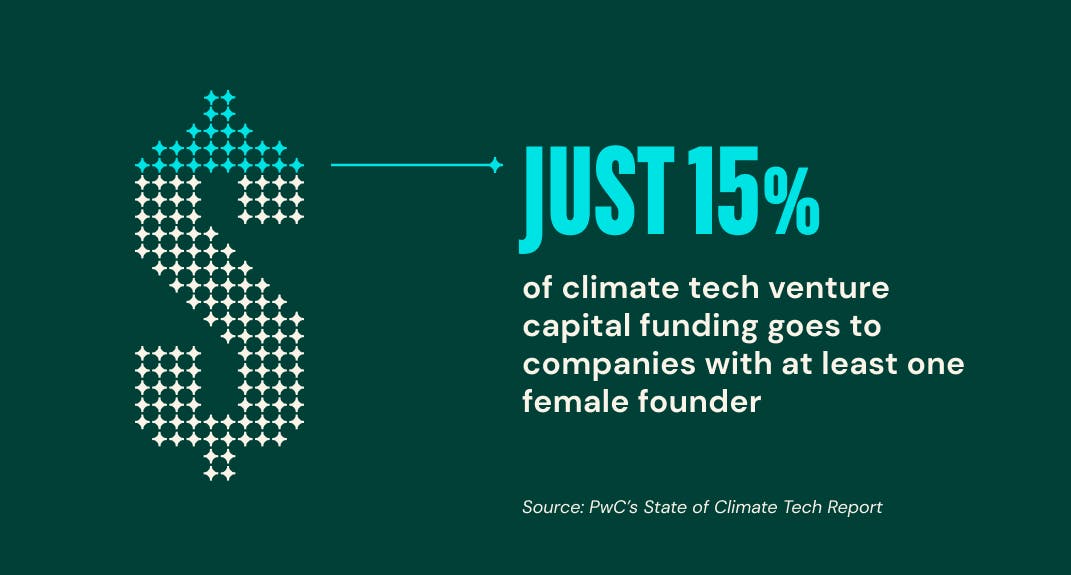

That’s just one of the reasons I was so excited to talk more to Laura, who is also an investor and Board Observer in Arcadia. Neither of us expected to land in climate work. Laura planned to work in policy and I started my career as a corporate lawyer. Yet here we are. I helped found a major climate tech company, and Laura helps companies (including Arcadia!) build innovative, impactful climate solutions. In an industry where gender representation isn’t exactly equal — according to a report from PwC, just 15% of climate tech venture capital funding goes to companies with at least one female founder, and women made up less than 25% of the energy industry workforce as of 2019 — our paths are a little unusual.

Are we getting the best solutions that we could possibly get? Are we moving as fast as we could possibly move? If we can engage everyone on this climate journey as fully as possible, I think we'll get there faster.

Laura came to the Drawdown Fund following 20 years investing in high-growth technology companies. Working with Rosetta Stone turned her onto the unique culture of mission-driven companies, and she decided to make her own next chapter more purpose-driven. After connecting with Paul Hawken, Laura started to dive into the work of Project Drawdown and climate VC investing. The rest is history.

So I couldn’t think of a better person to talk to about a topic near and dear to both of us: how we close the gender gaps in climate tech, especially in climate tech funding.

Our conversation has been edited for clarity and length.

Kate Henningsen: What was your path to venture capital?

Laura Witt: I was a political science major, so I thought I was going to do something in government or policy. And I basically didn't get a job offer! So I went into consulting out of college. That gave me some exposure to working with entrepreneurs and working with people who really want to take something and shape it and build it. It also opened my eyes to this whole world of alternative investing. I went to business school very much with a focus on how do I get to work with those entrepreneurs and really help them realize their dreams?

At what point did you start to think about a move into the climate tech world?

It was not constantly on my mind. I worked in tech investing for 20 years. I got to the point where I felt like, "Okay, I want this next phase of my career to be something that is more explicitly about purpose." And I will confess, I thought that that was going to be investing in women entrepreneurs and women CEOs to help close the funding gap for women. I’d seen the data showing that female founders receive only 2-3% of venture capital funding globally.

But I ended up talking with some people who were in climate investing, and that got me thinking maybe this isn't just a big, inevitable problem. I started digging in and looking at what are the companies in these climate solution sectors? What kinds of climate solutions are out there? Where's the opportunity to invest in growth companies in these sectors? Are they really going to be financially successful for investors as well as driving the desired impact for the planet? And as I started digging around and doing that research, I realized there are companies out there that have really valuable solutions. They're delivering economic value to their customers. These are market-driven companies that are oriented toward succeeding in the market as well as delivering on their mission. And so that clinched it. I said, "Yes, we can do something about this. Let's go do it."

You mentioned that you initially thought that you were going to work on closing the funding gap in terms of women founders and CEOs when you were looking for something more purpose driven. Why was that important to you?

It seemed like there's a dislocation in the market. Because I know for certain women and men both have great ideas. I know for certain that women and men both are willing to take risks and try to change things. That should be represented in entrepreneurship and building new companies and capital formation around those new companies. And yet, you can look at the data on capital flows and see how disproportionate it is for female-founded companies. And so I thought, "Why is it that these female founders and female CEOs aren't finding their way to the capital as effectively? Is it because they aren't as networked in? Is it because they don't market themselves as aggressively?”

And I try to think about, what does that whole value chain look like and where are the points that need to be addressed? Is it at the point of funding? But then if you work all the way back — and I used to see this in tech investing, too — are there as many female engineers, are there as many female software developers, are there as many female chemical engineers? If there are, what's helping those women to move into the senior roles, to feel like they can take the risk of starting a company or even moving to a start-up situation, rather than working for a larger corporation that may offer more security?

What do you think is lost by not having more women at the climate solutions table?

It's funny, I was having a conversation with my 12-year-old daughter the other day, and we were talking about what has been the role of women in different societies and different historical periods. And she said something like, "But why wouldn't any society want to have the full contribution of half of its population? Aren't they just hurting themselves and their potential progress by not letting half the population participate fully?" And I thought, "Yeah, you kind of hit the nail on the head." So it's really a question of how we get the most out of everyone's talents. Are we getting the best solutions that we could possibly get? Are we moving as fast as we could possibly move? If we can engage everyone on this climate journey as fully as possible, I think we'll get there faster.

Being human and being a little vulnerable and showing that you have empathy for the human side of other people is actually a great strength.

Based on what you've experienced in the industry, what would you like to see change to make that gendered funding gap smaller?

One thing that we can do, and I think a lot of boards are doing this actively now, is anytime there is a discussion about the next senior hire that we need in the company, or how do we fill this senior role, to really push the discussion of female candidates. We need to make sure that we're interviewing female candidates and really trying to get that balanced representation in our executive teams and any leadership roles in the companies that we invest in. And the same is true for the investment firms. I see progress on that front. I believe that climate-focused firms are very aware that they're serving humanity — that's why we're all here. So climate-focused firms seem to be more aware of having all of humanity represented in our investment professionals.

We need to be sure that anytime we're hiring as a firm, we're thinking about, "Can we bring in a female candidate for this role and put someone on a career path where they can move to a senior position?" We also need to be actively pursuing companies led by women to invest in, and make efforts to get involved early with companies with female leaders, to provide mentoring and networking opportunities to help those women access capital more effectively.

What advice would you give to women looking to get into VC investing, especially in the climate space?

Put yourself out there. This is something that's developed over the arc of my career, but I thought, "Oh, if you do well in school, of course job opportunities will open up to you. And if you do a really good job on that project, someone will notice the good work that you've done and promote you." And we all know, as we get more experience in the real world, that it is as much about the relationships you build as the concrete work that you do. Relationships are so important in VC and investing; you have to build the trust of the companies that you want to work with, you have to build relationships with other investors. And so I would say, really be certain that you are focusing on building relationships anywhere you can. Get involved in organizations outside of work, feel free to invite people out for coffee and say, "Hey, tell me about your progress. Here's where I am in my career, and what do you think would be a good step for me next?"

I spoke on a panel of women investors once and we were all asked about our career arc, and every one of us said, "Something happened just by chance. An opportunity popped up, and we took advantage of it." I think that that's actually very different than a lot of men who think very carefully about their career paths. So that's another piece of advice — take some time to actually think about your goals and what path is going to help you get to that ultimate goal.

Are there other lessons that you've learned over the course of your career that you wish you'd known starting out?

I remember the first time I heard someone use the phrase "Bring your whole self to work." I thought, "Oh, can you really do that?" I came into the work world when we were all wearing suits and women were wearing skirt suits and you had to worry about, "Do I look as professional as my male colleague?" So the idea of, hey, I can talk about my family, or I can talk about this personal issue, and I can truly bring my whole self to work, that was not what I was thinking about when I started my career. I was thinking, "How do I fit in and how do I make sure that everyone respects me professionally and knows that I'm going to work just as hard as the guys are?" Now I realize that people develop the strongest relationships with those who have empathy, and being human and being a little vulnerable and showing that you have empathy for the human side of other people is actually a great strength.

That's so important in our now very virtual, still-remote world. Having that human connection is so crucial.

It's a real positive in this climate and climate tech world. As I mentioned, everyone who is in it wants to do something for humanity. Everyone wants to do something to help other people. Caring about our children and the next generation is a key motivator in this work. And so that is more front and center in climate companies, climate investing, that we care about other people. You can be warm and human and aware of everything that drives people's lives.