Q&A with Marilyn Waite, clean energy finance expert

Power Dynamics is an interview series highlighting the work, ideas, and voices of advocates working to build a clean energy future that is accessible, workable, and just for all.

The news recently has been full of stories of utility companies abusing funds to advance their own agendas. There’s a lot of money wrapped up in energy, and the intricacies of who has it, who pays for it, and who needs it are in many ways a justice issue. That’s where Marilyn Waite comes in.

Waite is a program officer in environment at the William and Flora Hewlett Foundation, where she manages grantmaking for climate and clean energy finance. More specifically, she works on transferring private capital investments from high- to low-carbon projects. Part of her work involves getting funds to clean energy projects in communities — including communities of color — that are on the front lines of climate change.

“We can’t solve climate change, we can't create a low-carbon future, without the capital.”

Waite came to clean energy finance through environmental engineering. She realized that finance was a huge barrier to clean energy projects and decided that she would switch her focus to lending and asset management that supports climate-mitigating solutions. She has worked across four continents in venture investment, start-ups, and low-carbon energy. The recipient of numerous fellowships, Waite lectures and writes about sustainable business, particularly women-led, green economy start-ups, and in 2017 published a book, Sustainability at Work: Careers that Make a Difference.

She took some time recently to chat with Arcadia about the relationship between clean energy finance and energy justice.

Our conversation has been edited for clarity and length.

Arcadia: How are you thinking about energy justice in your day-to-day work?

Marilyn Waite: My day-to-day work is all around mobilizing capital to solve climate change, which includes clean energy resources. Clean energy resources are more just resources. When we think about things globally in terms of who has access to energy, whether it be in the form of electricity or fuel, the populations without tend to be in economically poor countries [and] have historically been shut off — despite often having domestic oil and gas resources — from the productive uses of that energy.

When we think about energy domestically in the United States, we know that low-income neighborhoods, which are disproportionately neighborhoods where people of color reside, spend a disproportionate amount of their income on electricity and other energy, not to mention the embedded energy costs within food deserts.

Ever since the oil crisis in the 1970s and shift away from the gold standard, oil became (unofficially) a kind of currency. It’s so embedded in our real economy and financial markets. We’ve seen what that has produced: extreme inequities globally and domestically. When I think about mobilizing capital to solve climate change, which includes less bad energy and more good energy, less dirty energy and more clean energy, I think about who is able to get the financing for the clean energy resources.

How do you make that decision?

Part of the strategy that I manage is around mobilizing capital for all. In the context of the United States, that means that we have to get the credit unions and the community banks to loan, provide lines of credit, and invest in climate solutions because they are the ones that are in communities who are experiencing energy poverty. We can’t expect the largest bank in the US, which has a poor track record on both climate and racial justice, to solve that problem.

We have over 5,000 credit unions in the United States, which are trusted by both rural and urban communities alike, both Democrat and Republican, Independent, young, old. It is one of the most widely trusted financial institutions in society. Credit unions are embedded in all kinds of places. Why haven’t we capitalized on their presence to accelerate clean energy lending?

What is fascinating about that space is that even if you don’t care about the climate at all, and you are the regulator of the credit union, clean energy and efficiency becomes a new asset class for you. It becomes a way of diversifying your portfolio. You would be logically, economically inclined to have credit unions do this kind of lending because it diversifies their portfolio and reduces concentration risk.

When I think about mobilizing capital to solve climate change, I think about who is able to get the financing for the clean energy resources.

How do you make sure that the funds get to the actual communities that are on the front lines of climate change?

There are a few ways. [One is] via the financial institutions that are already working with those communities. Inclusiv is an example of a network of community-development credit unions — that’s what they specialize in. No matter where you are, there are likely to be cooperative structures that you can invest in. People Power Solar is an example of this.

There is the banking side, providing loans and credit. Ensuring that you bank with a sustainable bank or credit union, often B-Corp Certified or members of the Global Alliance for Banking on Values, is one way of aligning capital with climate action. Then there is the asset management side, often investing equity in small businesses, high-growth start-ups, and larger, more mature companies. Whether it’s through your company 401(k)/403(b), even if you are self-employed, you can align these assets with a low-carbon economy. The Next Egg has a subscription model where if you’re interested in investing locally, you can join and they present opportunities for retail investors — everyday households — where you can direct money to locally investing in those projects that benefit communities.

Have you seen any uptick in interest in clean energy investments with the pandemic and other changes to the forecast for the oil and gas industry?

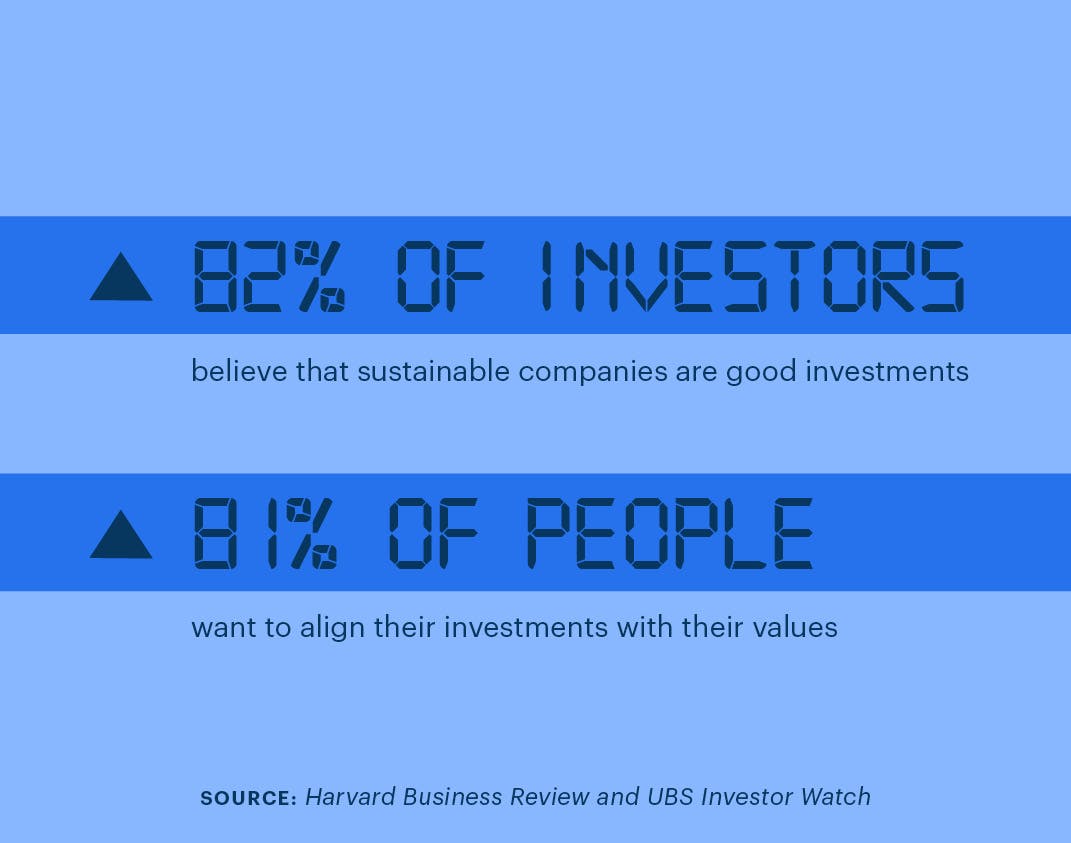

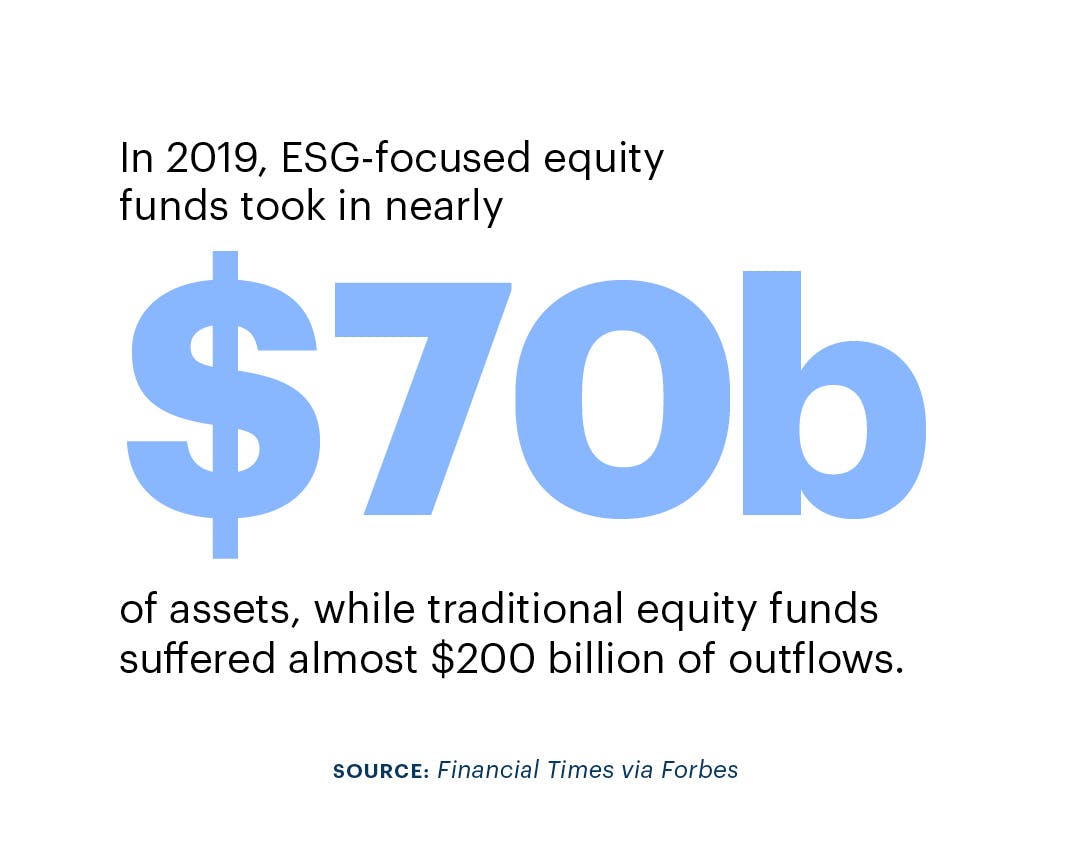

If you look at the numbers for environmental, social, and governance investing; impact investing; sustainable investing; climate-friendly investing, all of these things, the numbers tend to increase year on year globally. Fossil fuel returns have been tanking for years, way before the pandemic.

I think there has been a moment of reckoning and seeing which companies will bring investors long-term value. And that is very much in line with treating employees well, having a diverse board and staff, having good parental leave, and not polluting. It means being a good environmental steward and embedding carbon impact throughout the supply chain. All of those things, it so happens, are material to financial returns, and they build long-term value.

What does the ideal future look like for you, if we manage to tackle these issues?

I was recently in Montego Bay. It can be simultaneously depressing and motivating being on an island that is at risk of disappearing due to climate change. I went out and saw a coral reef, which was unfortunately dying. The reef wasn’t completely bone white, but it was pretty bleached. If I have an image of before and after, that’s my before image. And it could go either way, right? The reef could completely die off — that’s the direction we’re headed with climate change. Or it could be this thriving ecosystem of all kinds of colors and marine life. The latter is the ideal place where we want to live. It’s beautiful. It’s not just clean air and clean water, but also tasty, healthy food, people who are fulfilled in their work. And beautiful. I think that’s what the ideal future looks like.

Capital is the engine for that. We can’t solve climate change, we can't create a low-carbon future, without the capital. So that’s what we’re working on.

I think if we only “do sustainability” in the household, we won’t systemically transform the economy.

What came first for you? Was it an interest in climate change and environmentalism and you realized that finance was a way to accomplish that, or did your interest in finance come first and you realized it could be applied to climate change?

It was the former in that I studied civil and environmental engineering, with a bigger focus on the environmental side. I was working in low-carbon energy, nuclear and renewable, and that’s when I came across the barrier of finance and investment. Financers did not understand how they were mispricing their terms for low-carbon energy projects, including new and innovative renewable energy. I came from a more engineering, solutions-minded type of background, and fell into the barrier of finance and investment and decided that I’m going to deal with that barrier.

I want to ask about your book, Sustainability at Work. What motivated you to write it?

I was working in a spent fuel recycling plant in Normandy, France. While speaking with a safety engineer, I mentioned that I studied civil and environmental engineering; this is pretty standard — most engineers understand what that entails no matter where you are in the engineering field. But when I said that I then studied this thing called engineering for sustainable development, the safety engineer couldn’t understand what the two things had to do with each other. That’s when I realized that I was living in a bubble.

I became really curious to understand how people could apply sustainability and sustainable development to whatever job they were doing in a way that wouldn’t silo sustainability to just the home. I think if we only “do sustainability” in the household, we won’t systemically transform the economy.

I began to interview people who were in different fields. As I was collecting these stories, I realized, yes, I have a thesis that holds: you can “do sustainability” full time. Here is a framework for how you think about pursuing sustainability in careers. I think that when people start to make those connections, they actually can do their own job better, no matter what that job is. They can also begin to shift wherever they are, whether it’s a public or private institution, whether it’s a small start-up or a big company.